Advanced LNG & CNG Service Delivery

PROPOSAL FOR LIQUEFIED NATURAL GAS & COMPRESSED NATURAL GAS

(LNG & CNG)

ACQUISITION & UTILIZATION

Symmetry Device Research, Inc. (SDRI), can provide LNG and CNG in DOT containerization to your firm at a greater cost savings to your Organization thus allowing for a higher profit margin saving when compared with your current manufactured gas products. Through Marketing Research Support SDRI has found that service and reliability are major issues in acquiring and maintaining customer interest and loyalty in using containerized Natural Gas Products, thereby enhancing return on sales and expanding business in a failed deregulation market place here in California. Henceforth, all we need is your administrative and technical support to make it happen. Please see Exhibit A below.

SDRI would like to provide Wholesale liquefied Natural Gas to your firm by way of a trade agreement that will allow SDRI to circumvent pipeline transportation, shrinkage and other non-commodity charges from our supplier to any State. SDRI envisions that a credit can be given for Natural Gas Products of equivalent grade extracted from the pipeline in major port and pressurized at local facilities in certified Department of Transportation containers. SDRI will try to find a relevant copy of the Natural Gas Pipeline drawings running through applicable States showing details for compatible commodity exchange.The reason behind this offer is the expanding market for on-site energy generation and environmental concerns throughout the United States.

The sale of Micro turbines, Fuel cells, Diesel Engine Conversion, Standby Gas Reserves and the ability to control Utility Gas Prices and put Power on the Electric Utility Grid would be a win-win situation and has generated a great deal of interest in the Residential, Institutional, Commercial, Industrial, and Agricultural Markets. SDRI has worked up a methodology of standardization for the design, development, testing, manufacturing, installation, commissioning, operations, and maintenance for the various power generation matrices, i.e. Please see exhibits B & C Sales Confirmation and Distributed Generation Standardized Power Methodology and Application below.

Your firm’s Natural Gas compensation will come from SDRI’s Marketing and Sales Strategy and will be based on a negotiated price acquired by our Firms to process and inventory these Natural Gas Product either in Hayward or Richmond, California. This will in turn provide the information needed by SDRI’s accounting department to ascertain a profit margin needed for continued market growth. The protection of our market share will also require SDRI to invest in oil and natural gas wells, and will in turn enhance our ability in Distributed Generation Power Marketing.

It has been brought to our attention that when you invest in oil and gas programs, usually 75% of your investment is written off against your taxes in the year the investment was made. The remaining 25% is carried forward and amortized and written off too. The results is a tax write off with a potential high monthly income. Few other investments offer these types of benefits. Income levels may vary from well to well, and the possibility of a dry hole or non-commercial well does exist. In the event of a dry hole or a non-commercial well, the 100% write off is immediate. The basic tax consideration involved in investing in an oil and/or gas well with a company is as follows:

Dry Holes – All dollars invested are written off as an Ordinary loss against your ordinary income in the year it incurred.

Producing Well – 70 – 85% (approximately) of the amount of your investment constitutes what are known as intangible drilling cost, and are written off your ordinary income in the year it incurred.

Percentages – 15% to 25% of the investment constitutes tangible drilling cost (well equipment). This portion of your investment is depreciated over a seven year period using the Accelerated Cost Recovery System. In some cases, approximately 5-10% of the investment is considered syndication fees which will be amortized over a three to five year period.

Depletion Allowance – currently the allowance is 15%. This means that 15% of all revenues received are tax-free income.

To support our efforts, SDRI has already signed up over 5700 customers so far who are sensitive to issues of Environmental Remediation, Quality Power and Reliability of Generation. For example, our smallest customer has a monthly Natural Gas usage of Twenty Three Thousand Dollars ($23,000) per month, but when they convert over to Distributed Generation (on site power generation) they will increase the gas bill and reduce the electric bill for a large net percentage saving. This will provides SDRI with approximately $91,800,000.00 (annually) in Electrical Energy and Natural Gas Services Contracts. The Firm also has a marketing group consisting of 630 sales representatives who are eager to continue in their quest to establish our share of the Electrical Energy and Natural Gas Products Service Industry throughout the State of California and beyond its borders.

Summary of Client Benefits

|

Cost savings on commodity procurement of Liquefied Natural Gas and Electricity. |

Between 4-11% savings |

|

Reduce associated fees in commodity procurement. |

Reduce monthly fees by xx% |

|

Aggregate utility meter data for electric, Liquefied Natural Gas and Water. |

Provide utility consumption data on same platform for same time periods |

|

Provide utility consumption Data in all States. |

Develop real time pricing options Reduce utility billing errors Identify and implement efficiency savings |

Supplier Capitalization:

Our Client Manages a 12 Billion Dollar Corporation

developing Environmental Safe Material Resources.

Turnaround time to buy:

Upon consummation and completion of all documentation

acquisition would be one or two weeks.

Minimum Order Per Month or Total Annual Volume:

17 Million Cubic Meters per Month or in Cubic Feet the

volume would be 35.31 x 17,000,000 = 600,270,000 cu.ft

Cost Per Unit Anticipated:

Unit cost will be price per “MMBtu” ($4.87) & open to

negotiations to arrive at an indexed wholesale price.

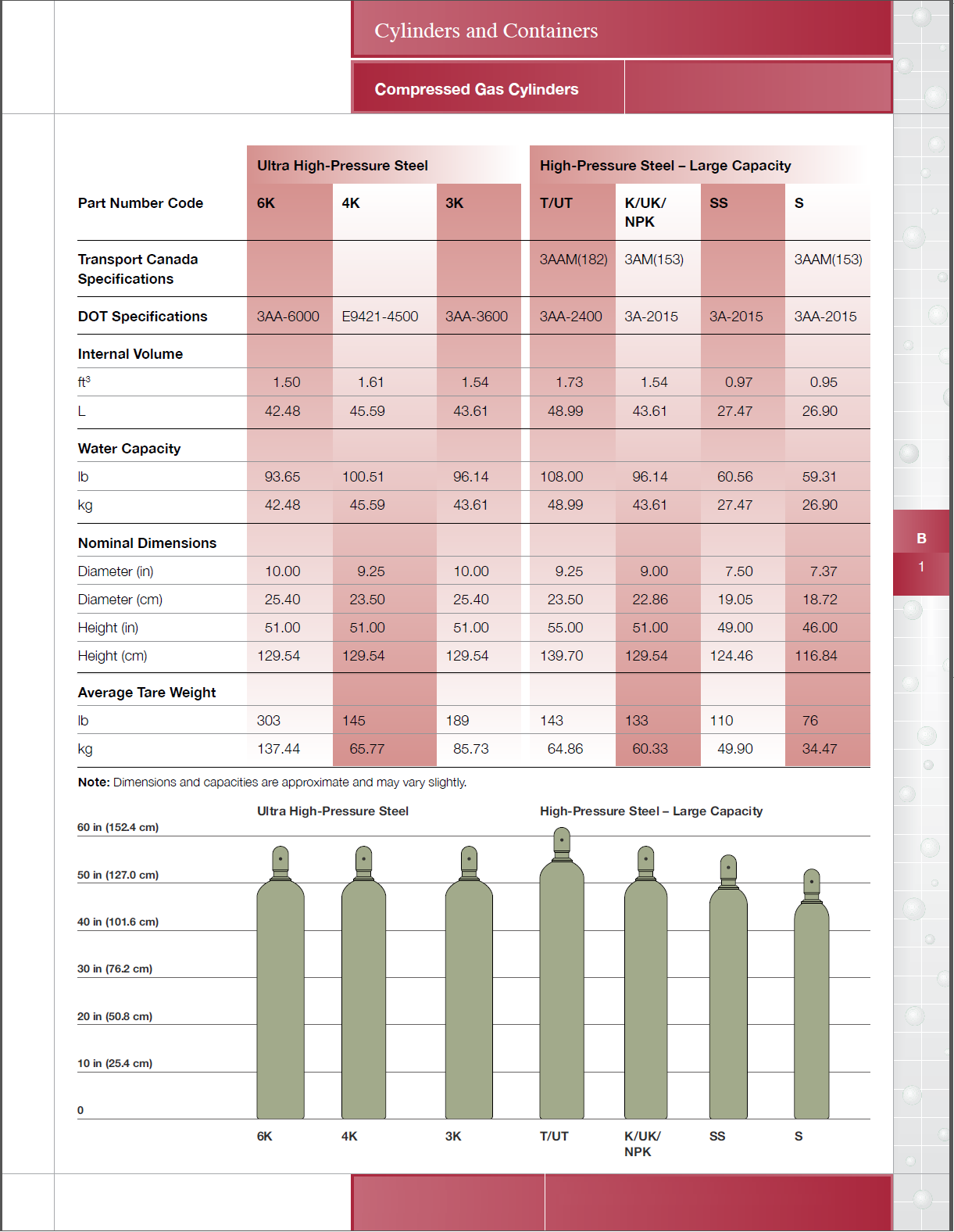

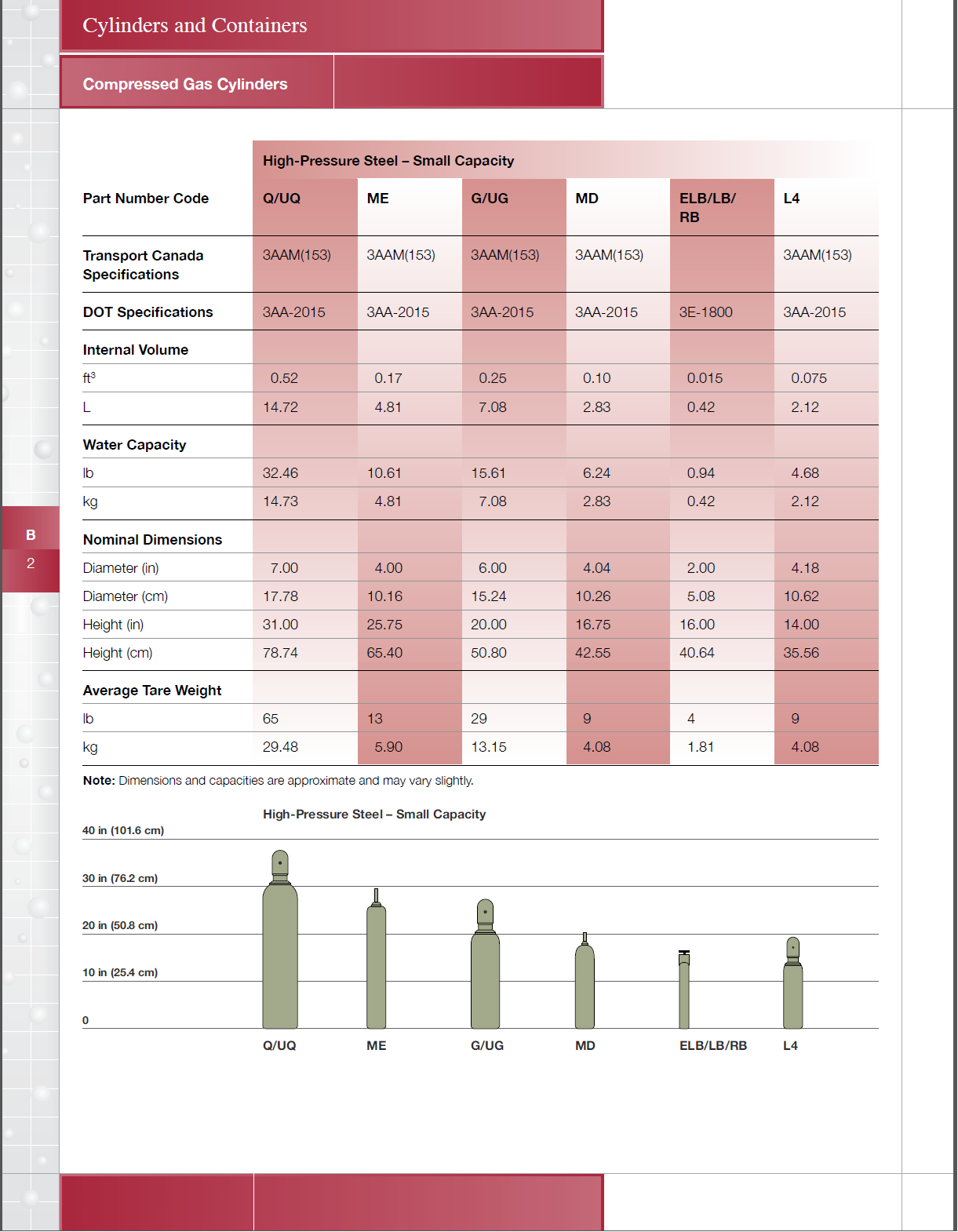

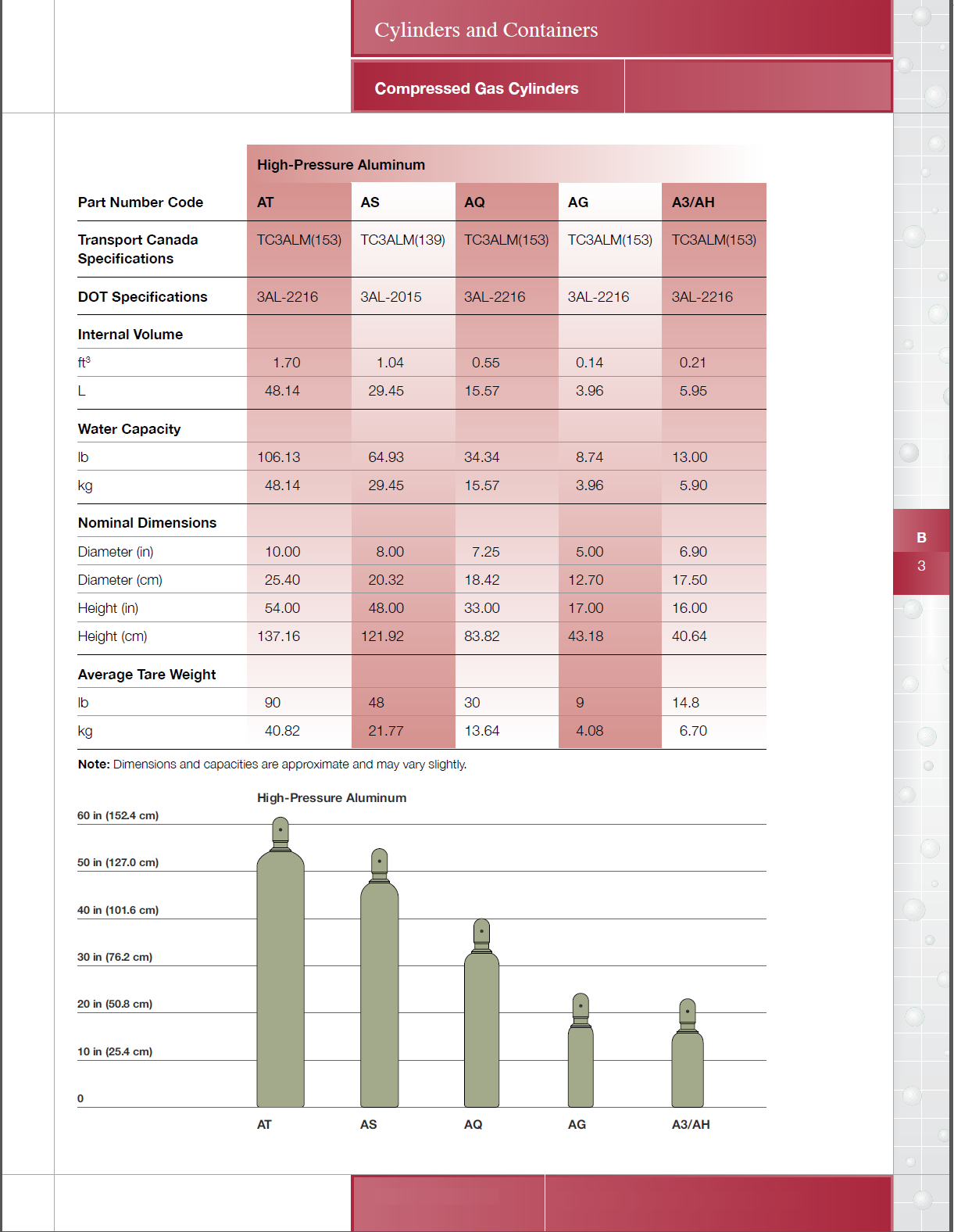

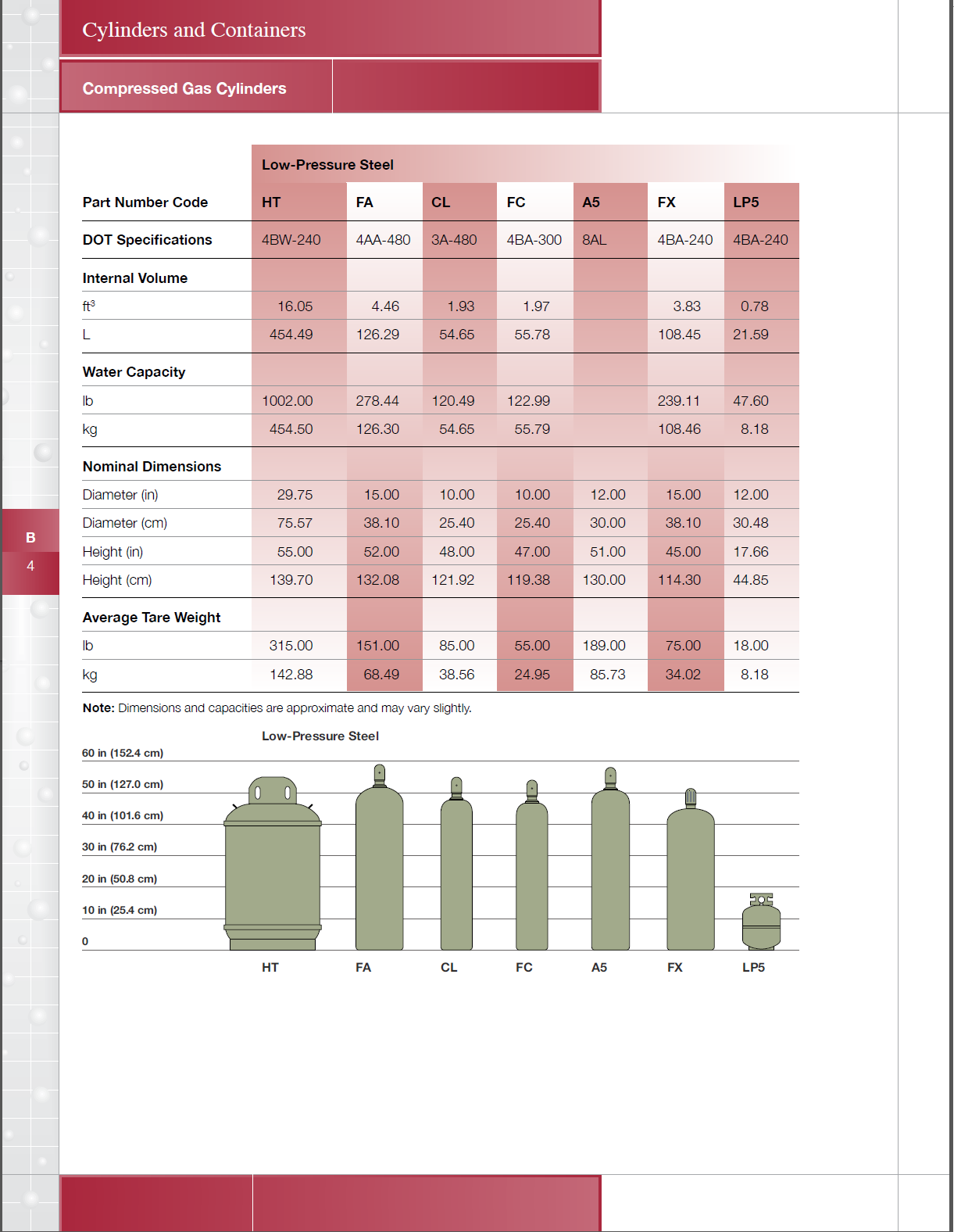

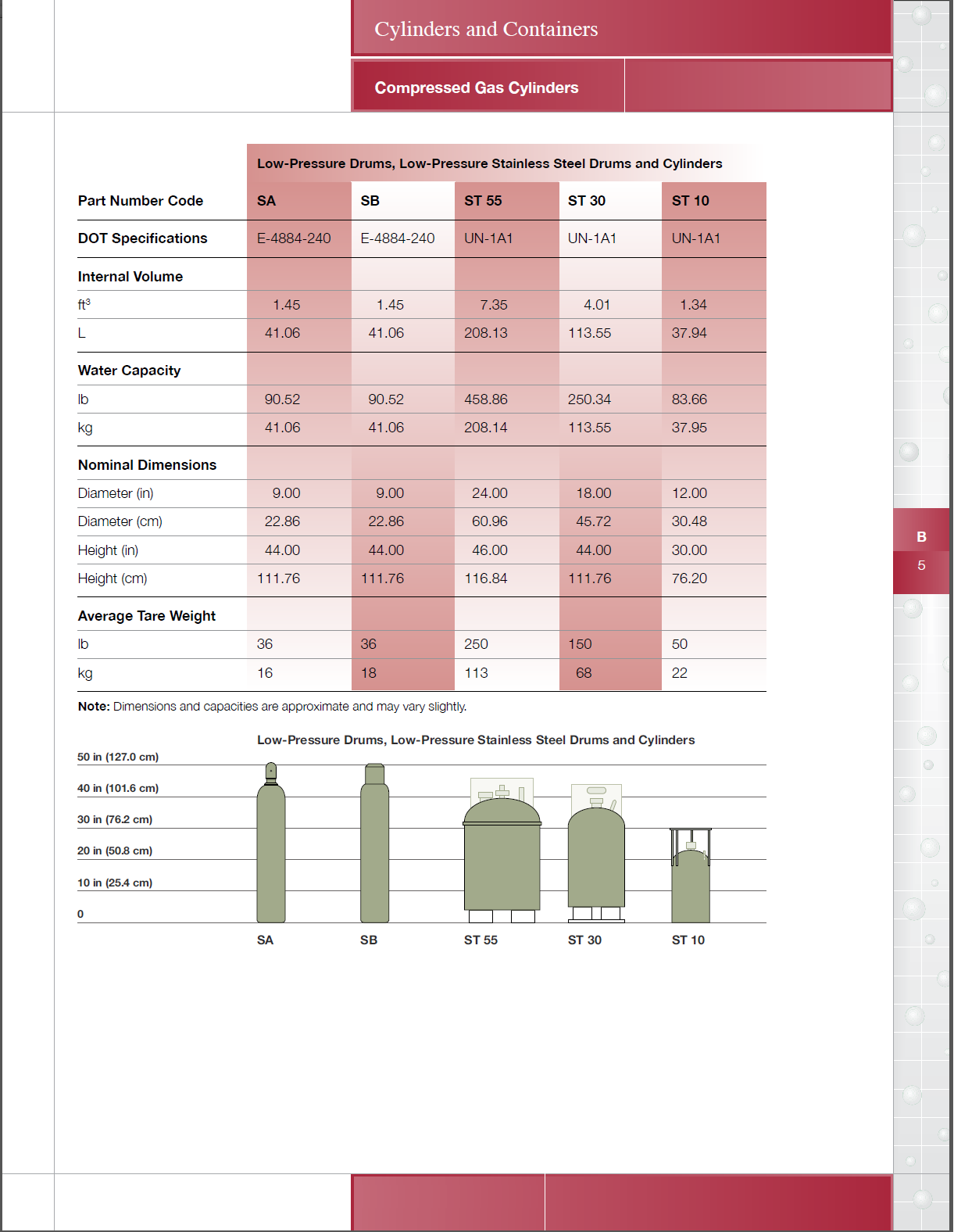

Method of Packaging or Container Size:

Natural Gas will be pressurized in certified Stainless-Steel,

Department of Transportation (DOT) canisters.

Method of Shipment & Delivery Location:

Ground, Rail or Air shipment as applicable to

location, delivery, weight, cost and schedule.

Grade of Gas needed: -Quality Requirements

Sweet Natural Gas or best quality low in sulfur

content and associated impurities.

Natural Gas Product Specifications & Applications:

A material quality data sheet should be produced

by a testing laboratory to measure consistency.

SDRI is licensed by the Federal Energy Regulatory Commission (FERC) to buy and sale federal Wholesale electrical energy and natural gas whether or not the utility markets of each state has have deregulated. We function as Power Marketers, Brokers, Aggregator, Energy Services Providers (ESP’s), Core Transport Agent (CTA), Meter Service Provider (MSP) and Meter Data Management Agent (MDMA) all in support of Demand Side Management, Energy Efficiency and Storage Conservation.

The benefits of Natural Gas Product Commodity Trading will allow for improved open market access in other states and regions, provide for price controls for spot market stability and enhance growth throughout national indexed cost variations. Also, if Natural Gas Products is at a lower cost outside your region and state we will establish trade agreements for its price against future low price consideration within Local Port Natural Gas Territory, containerized Liquefied Natural Gas (LNG) & Compressed Natural Gas (CNG).

I hope by now that you have been able to understand the benefits of SDRI’s proposal and how we operate, supporting demand side management by way of energy audits, calculating return on investments, which explains our Target Marketing Efforts, Commodity Wholesale/Retail Strategies, and Distributed Generation Issues for the 21st century. SDRI’s Competitive Advantage takes into consideration Obstacles and Risk, Profit Margin, Investments, Capability Statement, Company History and Management Team knowledge and skills to successfully implement our plan and strategy.

The failed de-regulated Energy Service Industry has given SDRI the opportunity to become established as an energy service provider (ESP) in its own right as a non-generating utility company. To further support equitable deregulation, SDRI’s license let by the Federal Energy Regulatory Commission (FERC), allows us to take advantage of a newly created program authored by the Securities and Exchange Commission (SEC) entitled 144a Security Bond Program. This article is published in the Code of Federal Regulations (CFR’s) for the issuance of securities and bonds to raise capital for electric utility and natural gas projects. SDRI’s contact is Mr. Anthony Barone Securities and Exchange Commission (SEC) Division of Corporate Finance Office of Chief Counsel https://www.sec.gov/ 202-551-3500

Applications: Renewable Energy Technology for an EPA Clean Environment.

Note: These are tax opinions on Crude Oil and Natural Gas Products which generally hold true for most investors but are not guaranteed, as tax laws may change. Please consult your tax advisor with respect to individual tax matters concerning this type of investment or send an e-mail to oil and gas investor.com.

PRESSURE VESSEL SPECIFICATION (Exhibit A)

Seamless Stainless Steel pressure vessels are manufactured to the ASME UPV Code Section VIII Division 1 Appendix 22 Safety Factor 3:1 for dry gas, noncorrosive service. Vessels are vertically mounted in I-beam frames to minimize rust and maintenance. Case material designs can be 316 or 400 series Stainless Steels magnetic and non-magnetic canisters as requires by Local, State and Federal Agencies usage applications.

Each vessel in the assembly will be furnished with a 0.5 full port stainless steel ball valve on the front, a spring loaded safety relief valve on the rear with a 0.75 full port stainless steel ball valve between the vessel and the safety relief valve and a dome outlet drain valve. All safety relief valves are braced to meet manufacturer’s recommendations. The entire unit will be painted with epoxy primer and a white urethane final coat.

When evaluating the merits of this proposal be it for complete assemblies or single vessels, the supplier, user or installer should be aware of the following:

Since the natural gas fuel may not be dried to meet the requirements of SEA J1616, consideration must be given to the effects that condensed water, combined with certain natural gas constituents, may have on cascade storage vessels. It is well known that a correlation exists between high ultimate tensile strengths (UTS), hydrogen sulfide (H2S) stress corrosion cracking and Hydrogen (H2) embrittlement. CPI has, therefore, imposed maximum UTS of 135,000 PSI for vessels used in CNG or LNG service and has subjected the steel to design qualification in sulfide stress cracking test made in accordance with Clause 14.3 Standard B51-95, Part 2. End plugs (either forged of machined from bar stock) utilize a material that is also capable of meeting, as a minimum, the same toughness requirement imposed on the vessel material by the ASME Code. Furthermore, the plug material has the same maximum UTS which precludes susceptibility to H2 embrittlementof sulfide stress cracking.

The ASME Code requires that all quenched and tempered (Q&T) forged steel pressure vessels be examined by liquid penetrant or magnetic inspection. The code does not require an angle beam ultrasonic (UT) inspection. The magnetic particle inspection method is used by most manufacturers due to its case if implementation. This inspection has been specified to find quench cracks and will detect deep, subsurface, mid-wall, or internal surface defects. An angle beam ultrasonic inspection to a 5% notch calibration ensures that no defects exceeding 5% of the minimum wall thickness are present after fabrication, thus greatly diminishing the possibility of H2S embrittlement. CPI Industries performs an angle beam UT inspection in addition to magnetic particle inspection on all ASME pressure vessels used in natural gas service.

NEPA 52, Section 2-9 (1995 edition) and The Railroad Commission of Texas CNG & LNG Regulations specify that shut-off valves must be capable of withstanding a hydrostatic test of at least four times the rated service pressure without rupture. All valves used on CPI pressure vessels and assemblies meet a safety factor of 4:1

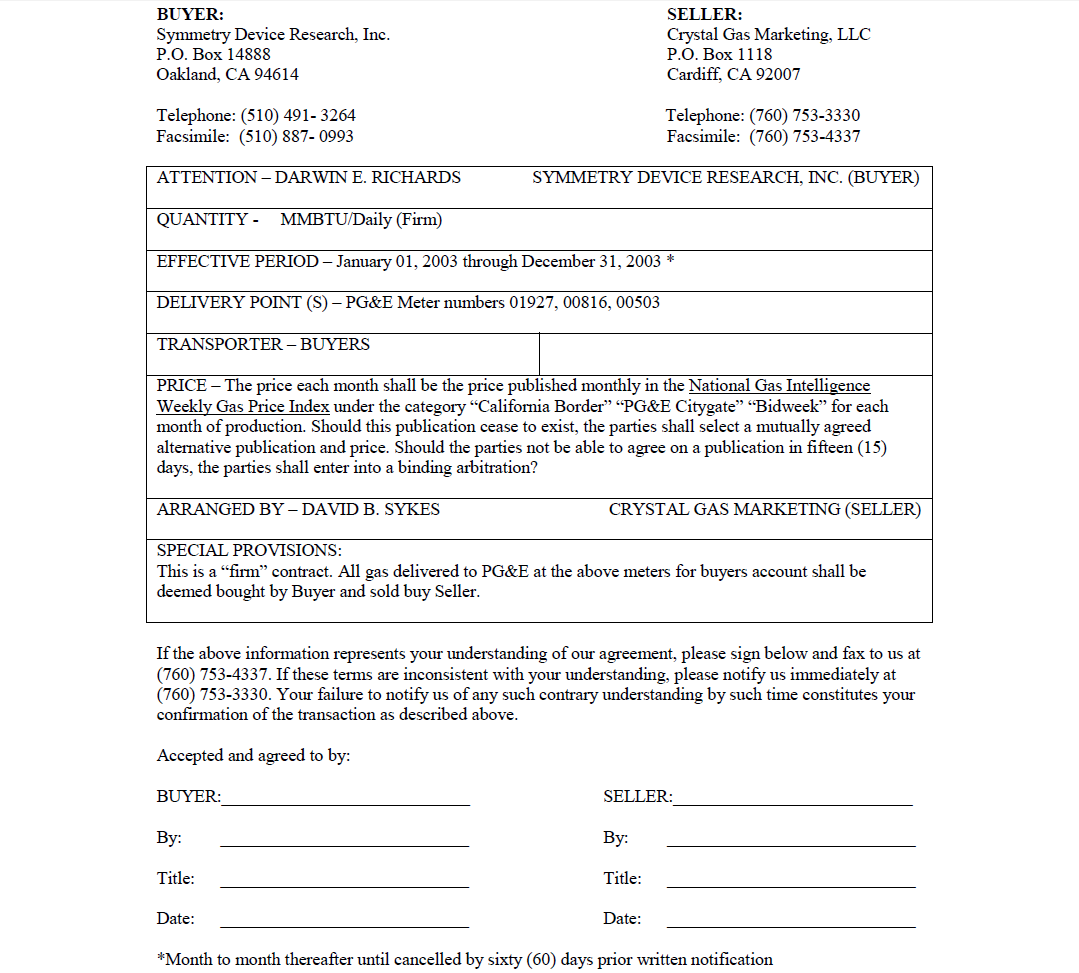

SALES CONFIRMATION (Exhibit B)

Contract No. 9975301

Project Name: Distributed Generation Standardized Power Methodology and Application (Exhibit C)

The construction of SDRI’s Distributed Generation Dual Cycle Gas Fired Turbine Energy Delivery Project for the Factory is to modify, upgrade or change-out the on-site standby/backup electrical power supply system by converting it over to become the primary delivery source of electrical energy using (co-generation) natural gas directly and indirectly through containerized storage. The diesel motor and generator-alternator have to be resized to the same capacity as PG&E’s utility grid lines and converted the use from diesel fuel to natural gas.

The Factory’s electrical drawings produced by SDRI will be reviewed to isolate related load points for demand sequencing if applicable to energy conservation. Sensor relays are used to achieve this potential energy efficient benefit, which will be tied to the newly installed Automatic Meter Reading (AMR) system. This AMR system monitors, measures, data logs and provides diagnostic analysis of your new electrical energy and natural gas system usage. This will allow continue comparative analysis with Utility Company cost. The Factory’s main electrical distribution panel will be disconnected and reconnected through the switchgear tied to the underground distribution transformer allowing for power sales or credit when electrical energy is added to the utility grid.

If you continue to use power from the grid the installation of a new AMR System would eliminate high side readings, demand charges, power factor cost, excessive gas consumption through improved filtering and will provide accurate usage information for Natural Gas, Electrical Energy, Water and/or Steam flow which will show precisely what you owe on a paperless invoice. Aggregation and automatic load distribution will further enhance energy efficiency and conservation for additional cost savings. The non-intrusive ARM technology is both telephone hard wired and wireless communication capable.

SDRI previously in partnership with Teldata Solutions (dba First Point Solution but retains the ARM Technology) provides net meter data acquisition services general known as “meter data management agent” (MDMA) functions for single or bundle utility billing and settlement. Additional, SDRI together with partner Genesis Data will support your needs for hardware and software upgrades. Our Firm’s experience and patented technology is capable of reading and managing data no matter whether a facility is located in a state or jurisdiction with open access energy service or in a fully regulated utility service territory. SDRI’s technology provides data on customer’s electrical energy, natural gas, and water consumption via the Internet platform. The platform can be one managed by the Factory or SDRI’s website, or a third party Internet site.

The ability to analyze multiple utilities metering information using web-based communications will increase your satisfaction; provide timely inputs for necessary decisions, and performance feedback for budget evaluation. The Factory facility staff can also learn the benefits of using centralized feedback information about the performance of your entire utility system. With regards to your renovation project the following information will be of special interest to Architects, General Contractors, Cities/Counties, Utility Consultants, Energy Auditors, Facility Managers and Building Engineers designing for commercial and non-commercial Energy Efficiency and Storage Conservation compliance through Title 24, Parts 1 through Part 6, enforced by The California Energy Commission,Leadership in Energy and Environmental Design (LEED) and other Federal Energy Agencies.

- Monitoring your facility data over the World Wide Web.

- Measuring, verifying, and managing electrical energy usage.

- Monitoring natural gas, water, steam, heat and pressure.

- Allocating energy cost to internal departments or sub users.

- Capturing and logging electrical disturbances.

- Analyzing power quality and reliability problems.

- Remote shut off, alarming and early warning tampering.

- Predictive and preventative maintenance.

- Maximizing use of your system capacity and network.

- Environmental indoor monitoring (lighting, particle count,temperature, humidity, pressure and motion).

- Tracking energy efficiency and conservation through NET-AMR measurements and diagnostics.

- Multiple signal interface capability RS-232, IEEE-488, and SCADA protocols.

When the NET-AMR installation is complete, resized generator-alternator will now be tied to the main electrical distribution panels via the same switchgear through overhead conduit. Subsequently, the new standby/backup unit will incorporate an un-interruptible power supply (UPS) sized to match the existing and future power requirements of 150kW/185kVA/240/480Volts three-phase delta distribution network. The UPS is used for additional generating, storing, conditioning, delivering, peak-shaving and managing power quality and reliable electricity. This creates simplicity and minimal environmental impact to residential, commercial, institutional, Industrial and Agricultural end user.

The secondary A.S.C.O. transfer switch as currently used with the existing diesel engine standby/backup generator-alternator will be retained. The construction of this system and network will include the installation of a 750kW, 785kVA, 240/480Volts, 3000Amps, three phase main power generator-alternator, natural gas driven engine dual cycle, turbocharged integrating after cooler, with weather housing and critical silencer. This system will radically increase the reliability of the power distribution load requirements, improve power quality and lower the system network maintenance cycle. The secondary standby/backup unit will only come on-line if both direct and indirect (storage tanks) natural gas pipelines have been depleted, damaged or destroyed.

SDRI will install, rewire, test, calibrate and certify the installation of the primary and secondary emergency power distribution systems and their relative interactions. A State registered licensed Professional Engineer will review all additions and changes to project drawings with a signature and certification stamp showing all approvals. On a periodic or monthly base SDRI will provide various reports to specific management levels via the corporate e-mail system. The headings of these documents will reflect information concerning discrepancy reports, performance reports, failure analysis & reliability reports, corrective action reports, billing invoices and settlement reports. Full shut down of the Factory’s electrical system for construction, testing or maintenance will not be necessary. The Natural Gas Products System will be interrupted per schedule and during off peak hours to avoid business shut downs. Again this will support a paperless process for all pertinent data to support the management of general operations.

Inspection and permit fees for the Factory’s diesel fuel tank removal will cost approximately $3,500.00 to $7,500 dollars, with additional cost for labor and material disposal. Application processing according to Ms. Paula Stewart with the Hazardous Materials Inspection Department, will take ten to twelve (10-12) working days to process with three day prior notice before permit approval process begins.

City Civil Engineers Certification Stamp on shoring procedures is required before removal of the diesel fuel tanks can take place, per street permit directives. The Permit and License numbers for all required personnel and trades such and electrical, mechanical, drilling/boring and arc-welding are noted and included. Subsequently, the work can start in approximately three (3) to five (5) weeks.

Your Distributed Generation Project can enable electric utilities to increase system capacity without some of the negatives consideration associated with longer lead-time investments. Moreover, distributed generation could evolve as an important, timely tool in the control of transmission loses and distribution line congestion management. Application of proven Demand Side Management Technologies will only be deployed through the planning and strategies of small high tech Corporation. This is true because large fortune five hundred corporation have huge investments retained or tied up in older standard devices, circuits, systems and networks.

In a recent rule making issued by the Federal Energy Regulatory Commission (FERC) on Regional Transmission Organizations (RTO’s) all new RTO’s once formulated, will have up to a three-year time posed to develop congestion management strategies. Where time pressure exists and opportunities require shorter-term strategies, distributed generation could be a critical part of the solution. The installation of this technology will enhance the overall energy industry and will give you and our customer base the first opportunity to enjoy its energy efficient savings and conservation benefits, while showing a direct correlation between technology improvements and cost savings or cost avoidance.

Attached is Exhibit “D”, SDRI Service Planning Sheets, which is straight forward because, the Factory already has an established electrical load and natural gas usage rate. This data and other relative information collected from drawings by your Architects “Hertzha and Knowles will be forwarded to PG&E to notify them of your change in service. Information that is currently unavailable, and if needed, will show a “UA” (unavailable) recording on SDRI’s “Exhibit D” Service Planning Sheets until it has been acquired. Also, attached, is the updated “Budget Quotation” which will be the final cost estimate for this project. End Of Example!

Material Safety Data Sheets (MSDS) -

OIL AND GAS TAX WRITE - OFF

Tax Information:

DID YOU KNOW? When you invest in oil and gas programs, usually 75% of your investment is written off against your taxes in the year the investment was made. The remaining 25% is carried forward and amortized and written off too. The result is a tax write off with a potential high monthly income.* Few other investments offer these type of benefits.

(*) Income level may vary from well to well, and the possibility of a dry hole or non-commercial well does exist. In the event of a dry hole or a non-commercial well, the 100% write off is immediate.

Tax Considerations:

The basic tax consideration involved in investing in an oil and/or gas well with a company are as follows: (For more information, see the Working Interest section of our definition page.)

Dry Hole - All dollars invested are written off as an ordinary loss against your ordinary income in the year incurred.

Producing Well - 70-85% (approx.) of the amount of your investment constitutes what are known as intangible drilling cost, and are written off your ordinary income in the year incurred.

Renewable Energy Investment - 15-25% of the investment constitutes tangible drilling costs (well equipment). This portion of your investments is depreciated over a seven year period using the Accelerated Cost Recovery System. In some cases, approximately 5-10% of the investment is considered syndication fees which will be amortized over a three to five year period.

Depletion Allowance - currently the allowance is 15%. This means that 15% of all revenues received are tax free income.

Note: These are tax opinions of Oil-N-Gas, Inc., which generally hold true for most investors but are not guaranteed, as tax laws may change. Please consult your tax advisor with respect to individual tax matters concerning this type of investment.

A System used to Compress Natural Gas into LNG and CNG

BASF Chemical Company

100 Park Avenue

Florham Park, New Jersey 07932

(800)-669-2273

(973)-245-7201

Dynegy Energy Company

601 Travis Street

Suite 1400

Houston, Texas 77002

(713)-507-6400

(800)-633-4704

Kingsly Compression Inc

463 Brownsdale Road

Renfrew, PA 16053

(724)-586-2204

(724)-524-1840

Exterran Compression Inc

16666 Northchase Drive

Houston, TX 77060

(281)-836-7000

(832)-795-6882

Linde LLC

Oil and Gas Services,

575 Mountain Ave.,

Murray Hill, New Jersey 07974

(800)-755-9277

https://www.lindeling.com

sales.lg.us@linde.com

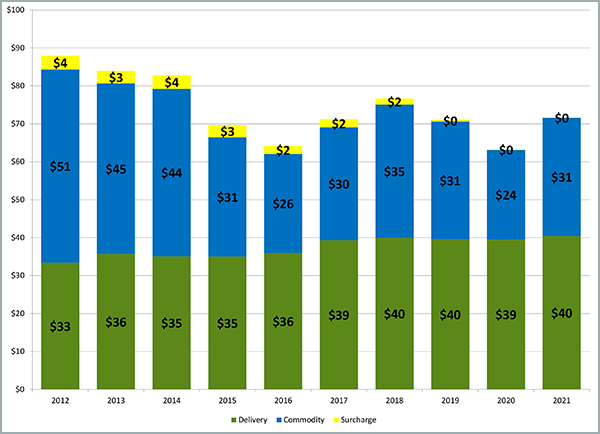

Typical Natural Gas Bill Data for Residential & Commercial Customers

Interested in what comprises a typical residential or commercial natural gas bill? The graphs below compare average monthly natural gas bills over the last ten years for residential customers who purchased their natural gas supply from PG&E.

Monthly Residential Natural Gas Costs

Based on average use of 1000 therms per year

The data in the above chart is based on average usage for a typical customer.

Individual bills will vary depending on specific usage.

Some additional information about the average cost data:

Delivery charge: What you pay PG&E to transport natural gas to your home or business.

- Revenue Decoupling Mechanism

(RDM), a charge or credit on your bill that reflects the difference

between forecast and actual delivery service revenues

by service classification to encourage the promotion of energy efficiency, energy conservation and renewable energy technologies.

Supply charge: What you pay for the natural gas purchased for you. PG&E makes no profit on your natural gas supply costs. The Supply charge also includes a Merchant Function charge, which represents the administrative cost for PG&E to obtain natural gas supply on their customers' behalf.

Surcharges: What you pay in state mandated charges, including the:

- Taxes: Includes the collection of Gross Receipts Tax (GRT) imposed by New York State and/or some local municipalities, where applicable.

- System Benefits Charge (SBC), which is used to fund

initiatives focused on reducing natural gas use in New York. This

charge was added in

October 2008.

- New York State Assessment, a special state

assessment for the state's general fund. This charge was added in

July 2009 and will continue through

June 2014.